Blogs

They could takes place, the newest progressive jackpots tend to drop whatsoever, it really will not become a daily density. Given that particular dragon totally free ports are progressive, its jackpots can also be reach impressively larger quantity, such as $40,100 to own Strange Dragon Position. On the other hand, not all dragon-themed slot video game have this element, so its best prizes are relatively brief, including, $5,000 to possess Fantastic Dragon Position.

Dragon Inspired Free Ports

The brand new wild signs come in both purple or blue and have already been wonderfully designed to link for the games’s wider theme. You might like to notice the dragons by themselves acting as extra wilds. 50 Dragons 100 percent free position can be found for the our very own webpages and will be played without the limits. Although not, you need to try your chances having real money and you can wager real at some point. To save you the issues, we already chose the best online casinos to experience having genuine currency. Prefer one casino you would like, and wear’t ignore to help you claim the incentive as well.

Losing is part of the game and you have so you can be prepared for it. Listing of Spin Castle needed gambling enterprises doing work in the uk and you will its permit, accepted and you can subscribed https://freeslotsnodownload.co.uk/slots/lucky-ladys-charm-deluxe-2/ because of the Gaming Commission. Playing must be fun, perhaps not a source of be concerned otherwise damage. Should you ever end up being it’s becoming difficulty, urgently get in touch with an excellent helpline on the country to own quick help. Slotsspot.com is the go-to support to have everything you gambling on line.

- You might expect an usually fantastical mode out of mediaeval villages and dragons increasing above.

- The brand new difference is very lower, and on such as game, the fresh enjoy has to be fun to compensate, you do get plenty of video game going back to finances inside format.

- Constantly try for simply how much you are prepared playing with regarding real cash plus don’t meet or exceed so it amount.

- WMS also has usually had certain rather erratic games, even when usually a bit less very, and sure of the contours, for example Huge Reels, much less therefore, even as we’ll establish soon.

- Jackpot icons conjure in the Wicked Wizard Jackpot game, the spot where the right treasure wallet you’ll spend your a jackpot worth around 5000x your choice.

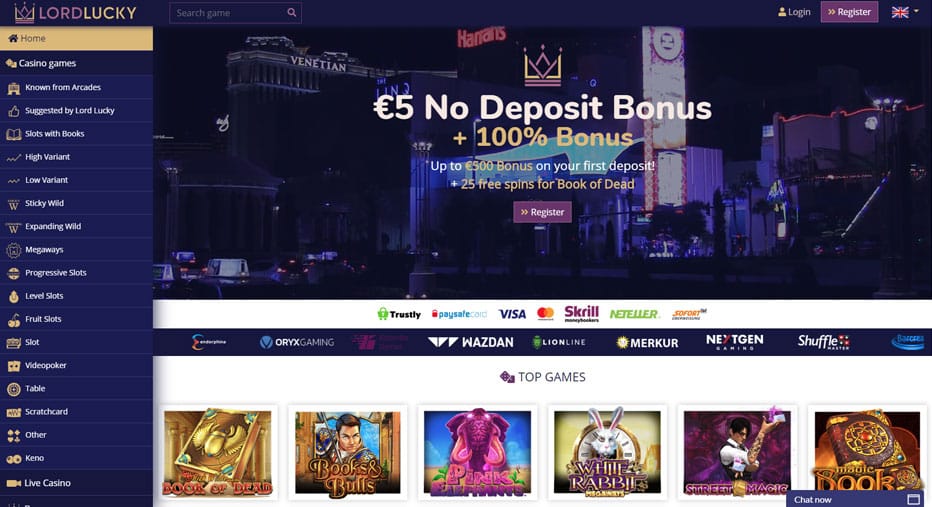

Common gambling enterprises

I am Joshua, and that i’m a slot partner which performs inside technology while the an advertiser by day, and dabbles inside the casinos occasionally throughout the of-minutes. Know Your own Slots tend to mirror my personal welfare within the understanding the various methods gamble slots, travelling, casino advertisements and exactly how you can get the most from your own casino check outs. If you utilize a tablet otherwise smartphone, the video game matches as well to the reduced windows for a great experience.

Yggdrasil doesn’t let’s down using this slot – it’s the primary mixture of design and you may wise mechanics. The range of features offered here’s destined to focus to numerous. While we resolve the issue, here are some these types of equivalent games you could take pleasure in.

However, there are a few freebies which can help mean a slot is almost erratic. Sometimes it’s the fresh characteristics out of how they are designed, often it’s a studio recognized for a specific type of online game. If searching for those that pay the extremely, be mindful of the fresh Koi seafood and Insane Yin Yang – they could cash-out as much as 250x the range bets when the you be able to home 5 to your a wages line. Delight button their device to help you land mode to play this video game. The game tend to possibly “announce” thata added bonus or big line struck is coming having a cartoon told by the theme ofthe game.

Twice DRAGONS Slot Added bonus Also provides

The fresh Commission’s said seeks is actually «to save offense away from playing, to ensure gambling is carried out rather and you can openly, and also to cover students and you will vulnerable anyone». Being tense and you can fluent, Double Dragons features with their rate and do not let bettors annoyed to have countless hours, that is of course an excellent. It range includes half a dozen headings in one plan in the renowned Double DRAGON struggle video game show one to assisted define a whole subgenre. We suggest that you always gamble sensibly and know when to prevent.

The newest Wheel out of Luck group of headings is actually very well-known and you will most other classics were Double Diamond, Triple Diamond, 5 times Spend and you may Multiple Red-hot 777 ports. Up to now, the fresh and exciting Sweepstakes gambling enterprises having be so popular in the us have not seemed IGT harbors. This is probably for a lot of grounds, however, mainly which they choose to remain on real cash gambling enterprises inside the Says where you will find Government controls in their mind.

The new Twice Dragons Feature awarded hinges on if or not you result in the newest Frost or Fire Free Spins. You have to know that there are a lot of great Dragon video game one keep developing month after few days. We’ll inform it greatest Dragon list because the brand new ones started away, nevertheless these are a few of our favourites for good reasons.

The online game also offers a main ability, and it s the new Dragon insane function. The new reels’ backdrops let you know lotus ponds and silhouetted pagodas which have a setting sunrays. Yang and Ting dragons try standing on the fresh reels and you may enjoying what you.

Enjoy RESPONSIBLYThis site is intended for pages 21 yrs . old and you will old. Double Dragon Video game offers an aggressive RTP rates one attracts each other casual professionals and big spenders. Within this review, we will view all the elements of the online game, as well as its features and you can overall experience, to help you determine whether it’s the right choice for you. Twice Dragons output 96 % for every €step one wagered back into the players. Spin the newest reels and you may advance the equipped champion out of left in order to right, where you need to overcome fatal barriers and mythical horrors to arrive the win.

RTP and you can Max Winnings Possible

This particular feature raises expanded nuts signs one stay-in lay while you are the rest reels twist easily. Next crazy symbol looks trigger the same effect, potentially answering four reels that have wilds to have ample winnings. People that like to try out which on the internet slot can enjoy another games offering this type of big monsters. The newest Ainsworth Action Dragon slot online game provides 5x multipliers, in the five free spins, and you can lots more. You can also are the fresh Aristocrat’s 5 Dragons casino slot games, where you are able to assemble regarding the twenty-five totally free spins, additional dollars prizes and you will win on the from the 243 paylines. Bring Mega Vault, a popular and also unstable games by the IGT, who doesn’t make games you to definitely erratic that frequently.

The online game now offers unique dropdown ability, highest pile wilds, and you can a x2 multiplier. The newest icons from playing credit provides plus the eyes orbs (Red-colored, Orange, Bluish, and you will Environmentally friendly) give wager size multipliers away from x4 in order to x125. The constant exploding tiles and you will flame and frost respiration dragons often help keep you mesmerised all day long.