SaaS companies use different accounting technologies, such as recurring billing platforms and subscription management software, than traditional startups or small businesses. These technologies require specialized knowledge and an understanding of best practices. When compared to other businesses, SaaS companies typically have a higher gross margin. Deferred revenue, also known as unearned revenue, is the portion of a company’s revenue that has been collected but not yet earned. In SaaS accounting, payments received upfront for yearly or multi-year subscriptions are considered deferred revenue.

- In fact, our team has been interviewed by TechCrunch about the metrics needed to raise rounds and trends in the VC market.

- The service is provided continuously, but the customer is billed in installments.

- Therefore, it’s important that your finance team ensures your forecasting and reporting are fully accurate and compliant with the appropriate tax rules and laws in your jurisdiction.

- One recent study found that 6,823 SaaS companies served the marketing industry as of 2018, and that 73% of organizations will be using SaaS for all their applications by 2021.

- Remember, we’re here to guide you every step of the way on your journey towards financial harmony.

- Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.

- To learn about these regulations in more depth than we’ll be going into here, check out FASB’s summary of ASC 606.

This ensures the projections align with your business narrative and makes sense in terms of the SaaS industry’s financial norms. And we recommend a recurring budget vs actuals exercise, where you compare recent results with projections to understand how you are performing vs expectations. They set up our books, finances, and other operations, and are constantly organized and on top of things. As a startup, you have to focus on your product and customers, and Kruze takes care of everything else (which is a massive sigh of relief).

The Biggest SaaS Accounting Challenges

Bookkeeping enables businesses to provide the necessary information requested by these parties, which is vital to assess their ongoing operations. Bookkeeping also serves as an important record for investors saas accounting rules and lenders to check the health of their investment. This write-up will keep these goals on the forefront and guide businesses about the essential SaaS accounting knowledge, practices, and much more.

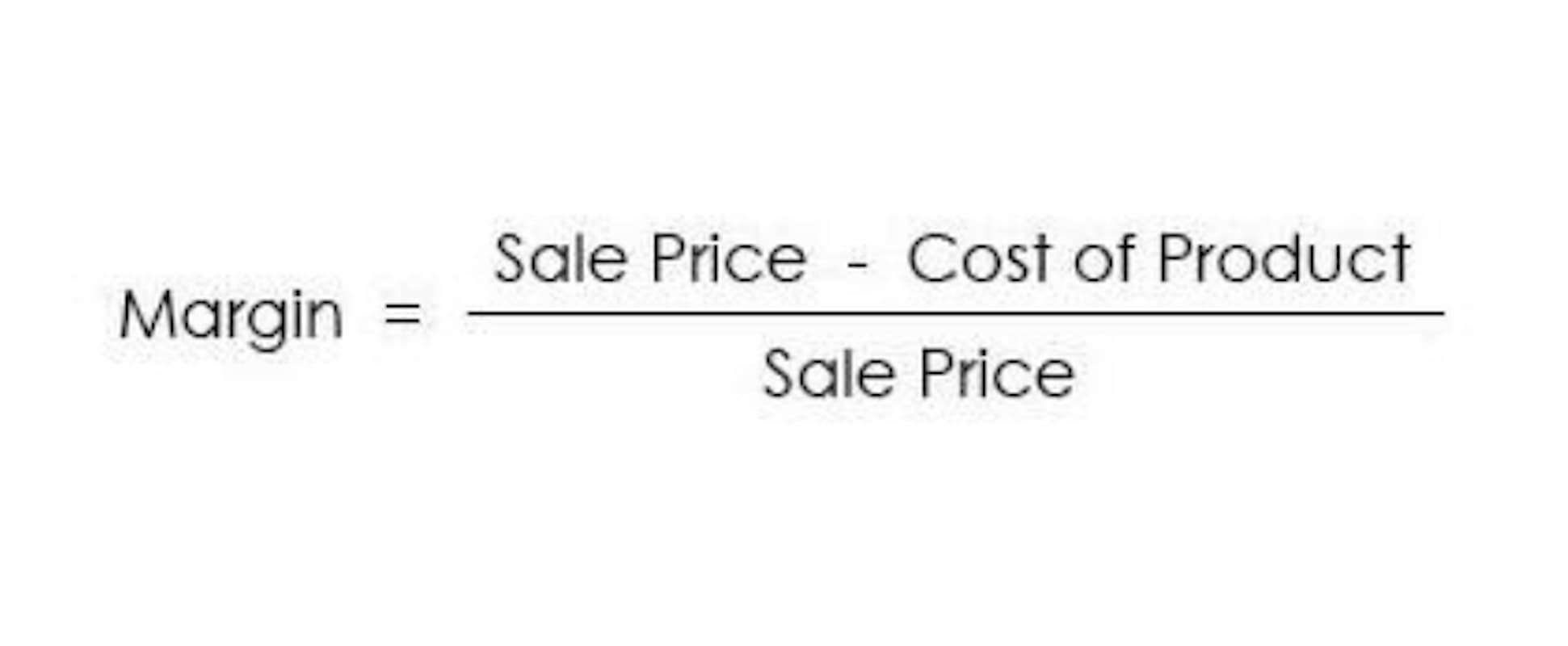

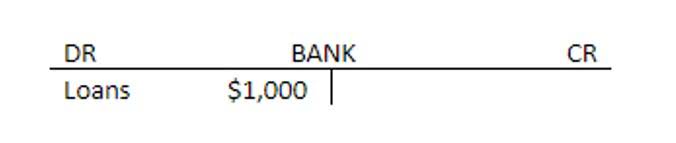

If a SaaS has high bookings but lower billings, it is a leading indicator of future cash flow problems. To maintain healthy cash-flows, SaaS businesses have to think of ways to get customers to pay upfront and increase billings. In the context of SaaS accounting software, revenue refers to the income of a SaaS company earned through the provision of its software services. There are two major accounting methods that SaaS companies deploy, called cash-basis and accrual accounting.

Startup Model Template

In this article we summarize financial reporting considerations and provide a framework for accounting for the related implementation costs. SaaS Accounting refers to the specific accounting practices and processes applied to Software as a Service (SaaS) businesses. It focuses on managing and reporting the financial activities and transactions unique to a SaaS business. SaaS accounting encompasses various aspects, including revenue recognition, subscription billing, cost management, and financial reporting. There are specific requirements and challenges to operating a SaaS business, and the financial intricacies of these businesses are also specific. The subscriptions that power SaaS businesses make it complicated for financial professionals to apply traditional accounting rules, taxes, commissions and contracts in their work.